8:44 AM American Airlines: Focus On Margins Not Competitive Pricing - American Airlines Group (NASDAQ: AAL) | ||||

#airplane flights # American Airlines: Focus On Margins Not Competitive PricingSummaryAmerican Airlines continues to producing record profits off strong pretax margins. The analyst community is overly focused on competitive pricing in select routes and not the complete income statement impact. The legacy airline with the largest capital return remains the most attractive airline to own. Despite record quarterly profits and substantial stock buybacks, American Airlines (NASDAQ:AAL ) hasn't seen any stock gains this year. Analysts are highly worried about the competitive pricing environment despite the ability of the airline to produce nearly $2 billion in Q3 profits alone. In addition, the company finished integration of the reservation system setting the airline up for synergy benefits in 2016 that my previous research recommended as a buy signal for the stock. At $43, American Airlines trades at roughly 6.4x forward earnings leaving one struggling with why the long thesis is so difficult for the market. Focus On MarginsThe earnings call was ripe with analysts gnashing teeth on walk-up ticket prices and the willingness of the airline to compete with ultra-low-cost-carriers like Spirit Airlines (NASDAQ:SAVE ). The odd part of the story is the unwillingness of the market to focus on what ultimately counts: pretax margins. This exchange on the earnings call particularly highlights the mindset of analysts that doesn't jive with the bottom line performance: Yeah. Love to do that. So okay, it's clear that you guys have concluded that ULCCs are a long-term threat in your market and they need to be dealt with and fine. That's your decision to make. But how do we know that you guys aren't totally blowing up yourself in the process of defending them, causing long-term damage on the pricing side while you're doing what you think you need to do to match them on fares. . we're pretty happy with our results so far, in markets where we've matched ultra-low-cost carriers, our RASM performance has been the same as it has been in the rest of our domestic system. So we've performed just as well. What we've done is we're running much higher load factors, particularly on formerly off-peak flights. We've done a really good job so far of directing that traffic to formerly off-peak flights running higher load factors, running lower yields. But our RASM performance even in the short-term has been equivalent to the RASM performance we've had in the rest of the system. And there probably are opportunities to fine-tune it, but that's normal course of business stuff that we do, and it's not going to be a meaningful change in terms of the number of seats. The management team successfully brought the airline out of bankruptcy, completed the merger with U.S. Airways, and integrated the reservation systems without any major mishaps. The market though isn't willing to reward this management group by only focusing on metrics such as ticket prices for walk-up customers in competitive non-stop routes. The end result is a stock trading at the lowest PE ratio of the legacy carriers off ultra-low earnings expectations for next year. The airline forecast pretax margins of 12 to 14% for Q4 that American Airlines recently rehashed after releasing the October traffic report . As a comparison, Delta Air Lines (NYSE:DAL ) forecast margins of 16 to 18%. American still needs to generate more synergies from the merger including the integrated pricing and efficient use of airplanes that will take at least 18 months to fully implement. These synergies will close this gap. At the same time, investors needs to understand that the impact from Love Field and the additional competition with Spirit Airlines and Southwest Airlines (NYSE:LUV ) is a bigger direct impact to American than the other legacy airlines. Capital ReturnsOne of the biggest signs that the airline industry is different this time around is the capital returns to shareholders. All of the legacy airlines are either paying dividends or repurchasing shares or both. In the case of American Airlines, the company is aggressively repurchasing shares. In fact, the airline has easily spent a larger percentage of the market value on capital returns than the other legacy airlines.

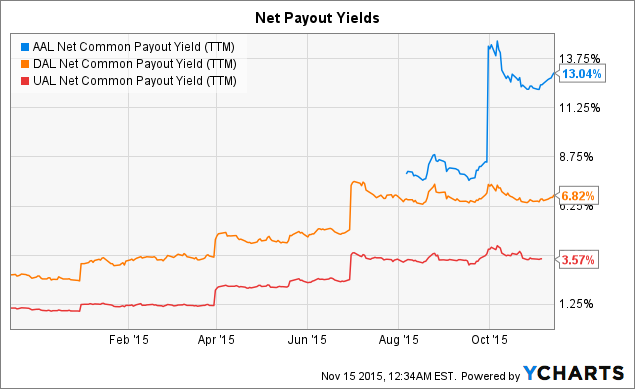

AAL Net Common Payout Yield (NYSE:TTM ) data by YCharts During Q3, American Airlines repurchased $1.63 billion of stock at an average price of $40.56. The airlines has returned an incredible $2.7 billion to shareholders the first nine of this year alone. Keep in mind that the stock is only valued at roughly $27.4 billion. The prime example of value is that Delta is only returning roughly 7% of the market cap to shareholders via dividends and stock buybacks. United Airlines (NYSE:UAL ) that completed the merger with Continental years prior to the American Airlines merger is returning less than 4% to shareholders. With the general perception that the airline sector is extremely cheap, American is the only legacy airline that spent the last year proving that to shareholders. Either the other airlines don't see the value or the company doesn't have the money. TakeawayThe key takeaway is to let analysts focus on pricing competition in a few markets while American Airlines focuses on the long-term value of the stock. The airline continues generating massive profits and substantial margins that feed the capital return programs. The recommendation remains to continue buying alongside the airline with the massive stock buyback program.

| ||||

|

| ||||

| Total comments: 0 | |