#student travel

#

Student Travel

Last Updated: September 3, 2015 4:23:55 PM PDT

Learn how to determine the payment type for student travelers.

The opportunity for enrolled students to travel as a part of their academic and extracurricular pursuits is appreciated. As UC San Diego is becoming a more global institution in teaching, research and service, travel is oftentimes international as well as domestic.

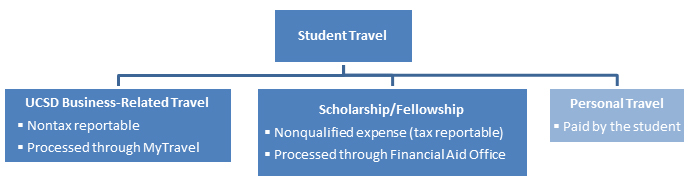

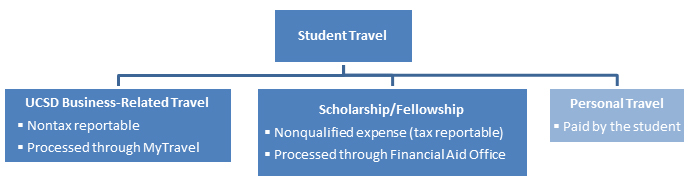

When is a payment for travel expenses considered UC San Diego business-related travel (nontax reportable) versus a scholarship/fellowship (tax reportable)?

For student travel, learn about the important distinction between official business travel and providing financial support. The explanations below are not all-inclusive and determinations may need to be made on a case-by-case basis. In general, UC San Diego payments for student travel will take one of two forms:

UC San Diego business-related student travel.

Student travel is generally considered UC San Diego business-related travel (nontaxable, nonreportable) if:

- The primary purpose and original intent is for UC San Diego to obtain useful results from the project/research.

- Results or research will be used by UC San Diego.

- Research is performed to fulfill UC San Diego s obligations to an outside funding agency.

- Activity is required of all students in a degree or course; that is, activity impacts the student's grade in a required course for the student s degree or is a requirement for graduation. The requirement to travel simply based on the dissertation topic does not qualify the travel as business travel. Rather, the degree program must state that all students are required to travel to conduct their dissertation research.

- Student is presenting in a conference or competition on behalf of UC San Diego.

Note: When student travel is for UC San Diego business, it is generally expected that all or most of the travel will be paid by UC San Diego as opposed to the student absorbing a majority of the expense.

Examples of UC San Diego business-related travel include:

- Student travels to Hawaii to represent UC San Diego in a scholastic or athletic competition.

- Student travels to Chicago to present at a conference, where the student's name (and that of UC San Diego) is published (poster, website, brochure, program) as a presenter at the conference.

- Student travels to Istanbul to perform research for her dissertation. This would qualify if UC San Diego would otherwise perform research on this topic, regardless of the student's research as such, UC San Diego is considered the primary beneficiary.

- Student travels to conduct dissertation research and has obtained his or her own external funding (including external fellowships) to support his/her research, with the funding provided to the University to administer either under a faculty PI or with the student serving as PI.

To document such business-related travel by a student, UC San Diego uses the UC San Diego Student Certification for Business-Related Travel form and supporting documents. (See Step-by-Step Process for Requesting Payments below.)

Scholarship/fellowship payment toward student travel.

When student travel doesn't meet one of the above criteria, a payment is consider a non-qualified scholarship/ fellowship. A scholarship/ fellowship is a payment or reimbursement to a student to aid their study, training or research. It includes payment towards tuition, fees, living expenses and travel expenses.

- Use for qualified expenses is nonreportable and nontaxable. Qualified expenses include tuition and fees, books, supplies, equipment and other related expenses required for the course.

- Use for nonqualified expenses is reportable and may be taxable. Nonqualified expenses include room and board, travel, research, clerical help, equipment and other expenses not required for the course.

For a U.S citizen or resident alien (under graduate or graduate students), payment is considered as taxable nonqualified scholarship/ fellowship income, but is not reported by UC San Diego to the IRS. It is the student's responsibility to maintain records for these payments (students should consult a tax professional on how to treat these payments for tax purposes).

Payments to nonresident aliens will be reported on form 1042S and may be subject to tax withholdings. Before a foreign student travels, make sure they have the proper visas to receive reportable compensation if the travel is determined to be a scholarship/ fellowship for nonqualified expenses.

The student travel payment is generally considered to be scholarship/fellowship (taxable, self-reportable by the student) if:

- Reimbursement is made for activities in which UC San Diego is relatively disinterested or the research is student-led.

- The project/research's primary purpose and original intent is to further the student's education or training.

- UC San Diego obtains little or no benefit.

- Activities are performed to contribute to the development of the skills needed in the student's studies.

Examples of Scholarship/fellowship for Nonqualified Expenses:

- Student travels to the Antarctica for dissertation research that is not research UC San Diego would otherwise conduct the student s dissertation is the primary purpose of the travel and the student is the primary beneficiary.

- Student travels to Washington for sign language training, which will assist in communication needed for degree. This is supplemental work that the student may need to succeed, but it is not a required part of the degree.

- Student receives a department award to be used towards pursuing academic activities (such as travel to attend a conference). The award may be provided to all students within a degree program or granted based upon an application/essay award process.

NOTE: Payments for services performed is considered compensation and must be paid through payroll, and foreign students must meet all visa requirements.

As a reminder, before a foreign student travels, make sure they have the proper visas to be recipients of reportable compensation if the travel is determined to be a scholarship/fellowship.

Taxes and reporting for UC San Diego student travel.

U.S. citizens and resident aliens

- Business-related travel is nonreportable and nontaxable.

- Qualified scholarship/fellowships are nonreportable and nontaxable.

- There is no tax withholding requirement for nonqualified scholarship/fellowship payments, but this income is reportable by the recipient. This income is not reported on a tax document (e.g. W-2 or 1099) but is considered to be self-reported income per IRS publication 970. Students may be required to pay estimated quarterly taxes to federal (IRS form 1040-ES) and state revenue offices on this income. Students should consult a tax professional on how to treat these payments for tax purposes.

Foreign students (nonresidents for tax purposes)

- Business-related travel is not considered reportable or taxable income.

- In general, the taxable portion of a scholarship/fellowship paid to a foreign student is subject to federal income tax withholding at the rate of 30%, unless the payments are exempt from tax under the Internal Revenue Code or a tax treaty. However, payees who are temporarily present in the United States in F-1, J-1, M-1, Q-1, or Q-2 nonimmigrant visa status are subject to a reduced 14% withholding rate on the taxable portion of the grant because such individuals are considered to be engaged in a U.S. trade or business under Internal Revenue Code section 871(c). This income is reported on tax document 1042S. Students may be required to pay estimated quarterly taxes to federal (IRS form 1040-ES ) and state revenue offices on this income. Students must hold the proper visa to receive such scholarship/fellowship payment.

- A GLACIER record must be completed.

Step-by-step process for requesting payment.

Note: As international travelers, students are subject to visa requirements of their destination as well as any restrictions set by their student visa if an international student.

- Graduate student financial support: Kathryn Murphy. Director (858) 534-3724

- Undergraduate scholarships: Becky Obayashi. Scholarship Coordinator (858) 534-1067

- Health sciences financial support: Carol Hartupee. Financial Aid Director (858) 534-4664